Reasons for using smartphone payments are ``speedy accounting'' and ``accumulating points''-MMD research institute survey

On January 31st, the MMD Research Institute released a survey report on smartphone payment usage trends. Among payment services using smartphones, we investigated non-contact IC types that use FeliCa other than code payments.

Based on the results of the "January 2022 smartphone payment (contactless) usage trend survey" conducted on the Internet from January 1 to January 5. Responses were obtained from men and women between the ages of 18 and 69. A total of 900 valid responses were extracted from 150 people each who mainly use the six services of "Mobile Suica", "iD", "Rakuten Edy", "QUICPay", "nanaco Mobile", and "Mobile WAON".

How did you learn about contactless payment services?

When we asked 900 contactless payment service users of six companies how they learned about the payment services they use, the top answer was " official website” (17.6%). It is difficult to think of arriving from a state of complete ignorance of the service, and we can see the high recognition of each service with a long history as the main Osaifu-Keitai service.

Second place and below are “store information and posters” (13.6%) and “information on related apps” (10.2%). As will be explained later, in addition to the convenience of the service itself, point rewards are a strong motivator for using the service.

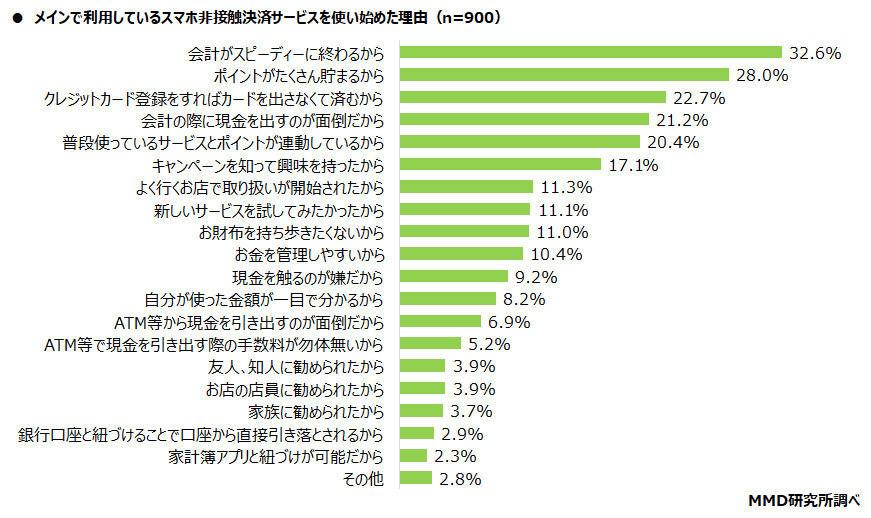

The reasons I started using the contactless payment service were: "Payment can be completed quickly", "I can earn points", and "I don't have to show my credit card"

The top three reasons for using the contactless payment service are: “Because the checkout is completed quickly” (32.6%), “I can earn points” (28.0%), and “I do not have to show my card if I register my credit card” (22.7%). In the fourth place and below, there were 21.2% who said, "It's troublesome to pay with cash" and 20.4% who said, "Because the services I usually use are linked to my points."

Compared with cash payment, of course, even compared to credit card payment, contactless payment is often even quicker considering the time and effort of entering a PIN and signing, and card payments are already cashless. It can be read that even people who have become fascinated by speed.

The top reasons differed depending on the service used, and many users cited Rakuten Edy and Mobile WAON as earning points more than the speed of billing.

"iD" and "mobile WAON" are used most frequently

We asked 150 users each who use six contactless payment services as their main 2 or more times a week" "Once a day" "4-6 times a week" "3 times a week" "Twice a week" "Once a week" "Once every two weeks" " Questions were asked on a 9-point scale of once a month and less than once a month. Mobile Suica (14.7%) was the most frequent user of “more than twice a day”, but it is a natural result considering the nature of transportation ICs, which are often used for round trips. Among other services that are mainly used for product sales, QUICPay (12.0%) and Rakuten Edy (10.0%) have a high ratio of heavy users.

When considering active users with high frequency of use at least once a week, iD and mobile WAON (68.0%) are the most common with the same rate. More than half of the users of other services also use it at least once a week.

Satisfaction/NPS is high for "Mobile WAON" When the survey was divided into four categories, Mobile WAON topped the list for benefits and trust, and Mobile Suica topped the list for app design and convenience.

Mobile WAON ranked first in the overall satisfaction of all four items, and mobile WAON was also the top in terms of NPS (Net Promoter Score / Customer Recommendation), which asks whether you would like to recommend it to your family and friends. .

![[July 6 and 7] DX realized by content cloud, advanced platform for business transformation](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/6bbafe438d78271513761788166cbf94_0.jpeg)