Kioxia's sorrow with long -awaited listing

Akira Fukuda's semi -conson industry

キオクシアホールディングスの株式上場に向けた歩み。同社の公表資料からまとめた"Stock openings (listing of stocks)", which is a symbol of independence for Kioxia, a major NAND flash memory giant, has been postponed just before.Kioxia Holdings, a holding company in Kioxia on August 27, 2020, has officially announced that it will be approved by the Tokyo Stock Exchange (Tokyo Stock Exchange) and will list the shares on October 6.bottom.

One month later, on September 28, 2020, Kioxia Holdings announced that it would postpone stock listing.Only eight days before the scheduled listing date.The new scheduled date has not been presented.Sudden postponements were various speculation.

The release of Kioxia Holdings on September 28, which announced the postponement of the listing, explained the reasons as "comprehensively considering recent trends in the stock market and concerns about re -expanding new colon virus infections."are doing.However, there are not many investors who are convinced of this explanation alone.

One of the reasons is the Kioxian customer, a major Chinese mobile phone manufacturer, Huawei Technology Co..LTD.The US Ministry of Commerce's export regulations for) came into effect on September 15.Kioxia has no longer supply NAND flash memory to Huango Technology.That said, this export regulation was predicted as of August 27, when the listing scheduled.In addition, Apple, small -American techniques (Xiaomi), and OPPO Mobile, which compete in the Hua Technology and the mobile phone terminal market, have decided to increase smartphones, and it seems that the loss of Hua Technology as a customer is not so great.

Another reason is that the initially assumed issuance price of 3,960 yen is very expensive (Bain CapitalPRIVATE EQUITY)PANGEA CAYMAN Group, which is very expensive at the initially assumed issuing price of 3,960 yen.(In fact, the consortium led by Bain Capital, an investment fund) has become difficult to sell stocks at a profitable level.According to the provisional conditions of the book building (demand declaration) announced on September 17, 2020, the price has already dropped from the expected issuance price, from 2,800 yen to 3,500 yen.Under these conditions, it is still expensive, and it is possible that the investor's demand declaration during the declaration period from September 18 to 25 was not good.

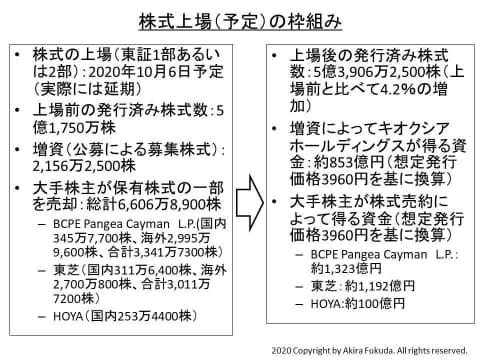

キオクシアホールディングスの株主構成。2020年8月27日現在の議決権ベースによる比率。同社の公表資料から作成The framework of stock listing announced on August 27 has a stronger personality of securing a major shareholder sales than Kioxia's financing.Kioxia Holdings will procure 83.5 billion yen by newly issued stocks, while BCPEPANGEA CAYMAN L, a major shareholder..P.Will be 132.3 billion yen, Toshiba will be 119.2 billion yen, and HOYA will be partially sold by shares of shares (if the sale price is 3960 yen).The total cash acquired by the major shareholders is about 261.5 billion yen in total, reaching more than the cash acquired by Kioxia Holdings.

Toshiba officially announced on June 22, 2020 that it will return more than half of the amount obtained when selling Kioxia Holdings shares to Toshiba shareholders.

キオクシアホールディングスの株式上場の枠組み。同社が2020年8月27日に公表したリリースをまとめたものキオクシアホールディングスが手にする835億円という金額は、NANDフラッシュメモリ事業に対する投資を充当するには、少なすぎる。本来の目的に沿う株式公開であれば、新規の株式発行数はもっと多くても良いはずだ。少なくとも1,000億円を超える資金を株式市場からは調達して欲しい。それができないところに、大株主(とくにBCPEPangea Caymanグループ)に対するキオクシアの弱さを感じる。

Meanwhile, Bain Capital, which is the leader of the consortium "PANGEA", which acquired Kioxia, has to be collected by the sale of stocks, with the sale of stocks.Of course, I want to avoid cheap sales.To put it further, I want to collect investment as soon as possible.Listing stocks is also an opportunity to maximize the value of holding stocks.If the number of new shares is too large, the value per share can be reduced.

Simple the benefits of holding shares can be summarized in two.One is a price rise.Short -term holders aim here.The other is a dividend.Long -term holders think here.In principle, both are based on good performance.

Kioxia's performance is not very good.According to the fiscal year (April -March period), the sales were the highest in sales for sales (2018), and operating income was the highest amount in the fiscal year ending March 2018 (2017).。In the most recent fiscal year ending March 2020 (2019), sales decreased by 22%compared to the previous year, and operating income fell into a deficit.The business deficit is quite large at 173.1 billion yen.

東芝のフラッシュメモリ事業(SSD事業を含む)およびキオクシアの会計年度別業績推移。2012会計年度~2017会計年度までは東芝のフラッシュメモリ事業および旧東芝メモリ(東芝の完全子会社)の業績(2014年度までは営業利益が公表されていない)。2018会計年度は旧東芝メモリ(東芝の完全子会社)および新東芝メモリ(Pangeaの子会社およびPangeaとの合併会社)の業績(注:厳密には2017年度との連続性がない)。各社の公表資料を筆者がまとめたものIn the quarterly basis, the highest operating profit in the fourth quarter of 2017 (January -March 2018) was recorded.After that, operating income continued to decrease, and operating income falls into a deficit in the fourth quarter of the 2018 fiscal year (January -March 2019) one year later.From there, the business deficit is recorded for four consecutive quarters.It is the fourth quarter of the 2019 fiscal year (January -March 2020), one year later (January -March 2020), one year later.In the first quarter of the 2020 fiscal year (April -June 2020), the business is still in the surplus.

東芝のフラッシュメモリ事業(SSD事業を含む)およびキオクシアの四半期業績推移。2017会計年度第4四半期(2018年1月~3月期)までは東芝メモリ事業および旧東芝メモリ(東芝の完全子会社)の業績。2018会計年度第1四半期(2018年4月~6月期)は旧東芝メモリ(東芝の完全子会社)(4月~5月)および新東芝メモリ(Pangeaの子会社およびPangeaとの合併会社)の業績(6月)を筆者が推定したもの(注)。同じく2018会計年度第2四半期(2018年7月~9月期)の売上高(新東芝メモリ)は筆者が推定したもの。そのほかは各社の公表資料を筆者がまとめたものIn summary, from the 2019 (last year), when the large deficit was recorded, the first half of 2020, which is weak but recovered.In the latter half of 2020, the industry is predicted that the supply and demand of NAND flash memory will be loosened.It is hard to say that it is very good for the timing of stock listing.

Kioxia Holdings announced on August 27, 2020 that it will overview of new listing.On August 27, 2020, the company announced its "medium- and long -term business goal."This goal suggests that although the most recent performance is not good, "you can expect good performance in the medium to long term."In other words, 25 % to 30 % of operating margins (NON-GAAP bases) were medium- to long-term business goals.In the three -year average from the end of March 2018 to the March 2020, operating margins were 22%.Aim for a high operating profit margin that exceeds past achievements.

However, the market conditions of the NAND flash memory are quite severe, so operating margins may exceed 30%or deficit (negative).The average from three to five years is 25%to 30%.Still, it seems to be a considerable target value.

キオクシアの中長期事業目標。2020年8月27日にキオクシアホールディングスが発表したリリースからHowever, the aggressive medium and long -term business goals were empty, and the listing was postponed.Kioxia Holdings will explore the listing timing to the end of 2020 or the first half of 2021.

It was on October 1, 2019 that Kioxia Holdings and Kioxia were born with the company name change.The predecessor, Toshiba Memory (Toshiba Memory (Shin -Toshiba Memory) after the acquisition of PANGEA) was launched on June 1, 2018, so nearly two and a half years have passed.Let's take a look at the current situation of Kioxia Holdings and Kioxia.

At first, the Kioxia Group was born on October 1, 2019, and has picked up the most important events.The Kitakami Plant (a new production building of NAND flash memory) was completed, the representative director was replaced, the sales of the Kioxia brand flash applied products, and the acquisition of a Taiwan SSD business company.What is particularly noticeable is the release of flash memory applied products such as USB memory, SD cards, and SSDs of the "Kioxia" brand for consumers.

キオクシアの発足から現在まで(略史その1)。キオクシアグループの公表資料からまとめたキオクシアの発足から現在まで(略史その2)。キオクシアグループの公表資料からまとめたThe current Kioxia Holdings and Kioxia company profile, list of directors, and list of executive officers are summarized below.

キオクシアホールディングス株式会社の概要。同社の公表資料からキオクシア株式会社の概要。同社の公表資料からキオクシアとキオクシアホールディングスの取締役一覧(敬称略)。両社の公表資料からキオクシアホールディングスの執行役員一覧(敬称略)。同社の公表資料からキオクシアの執行役員一覧(敬称略)。同社の公表資料からDue to the postponement of stock listing, Kioxia Holdings' shares have entered a very difficult stage.One of the important indicators to measure the timing of the listing is probably the quarterly after the second quarter of 2020 (April -June).Depending on the performance, the timing may change dramatically.I want to watch the whereabouts carefully.

[Akira Fukuda's semi -conson industry]の他の記事を見るGroup site linksCopyright © 2018IMPRESS CORPORATION.All Rights Reserved.

![[July 6 and 7] DX realized by content cloud, advanced platform for business transformation](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/6bbafe438d78271513761788166cbf94_0.jpeg)